Your Trading Edge Isn't Your Setup. It's Your Knowledge.

I shared a thought on Twitter recently, thinking it was fairly obvious—and then multiple traders messaged me privately with comments like:

“Hey, I've recently begun trading just one market and found better success. Thanks for this—I only wish I'd started sooner.”

It wasn’t groundbreaking—just something most experienced traders already know.

But those responses made me realize something important:

What seems obvious after years spent deep in the markets can genuinely open the eyes of traders still finding their way.

After speaking with several of those traders, it became clear that many deeply struggle to understand where their trading edge actually comes from.

That's why I wrote this article.

It's a practical guide distilled from years observing traders succeed and fail—field notes designed to refocus you on the true source of your trading edge.

Here's the original tweet:

Most traders think their inconsistency is due to weak setups, discipline issues, or psychology.

Usually, they're wrong.

This article is the playbook for that tweet.

Think of it as field notes from a decade of watching traders succeed and fail—a guide to building the deep, structural knowledge that transforms decent traders into consistent winners.

The harsh reality: generalists provide liquidity for specialists

"Trading multiple markets superficially isn't providing more opportunities—it's compounding ignorance."

Most aspiring traders I've worked with—whether at Raen or through social media—are trying to trade everything: ES, NQ, crude, gold, currencies.

They've learned patterns, hoping they'll work everywhere.

Markets trade very differently.

Each has unique participants with specific constraints. What works in ES might get you killed in crude. What's noise in Treasuries might be gold in NQ.

You have finite attention. Finite capital. Finite time.

Every additional market exponentially dilutes your focus.

While you're busy recalling gold-dollar correlations, the crude specialist sees commercial hedgers forced into predictable actions they've witnessed repeatedly:

Levels where commercial hedgers must act

Volatility signatures of weekly EIA reports

Times institutional orders provide predictable liquidity

Most medium-/long-term CTAs lag trend breaks by days

This isn't talent—it's accumulated knowledge from thousands of hours studying one market's specific behavior.

I've watched talented traders repeatedly fail by insisting on trading everything. They have decent setups everywhere but mastery nowhere. Meanwhile, the trader who only trades ES from 9:30–11:00 AM? He's been consistently profitable for a decade.

As I've explored in "Why Trading Edge Exists (and the 4 Forces Behind It)", markets offer four types of inefficiencies:

Behavioral

Structural

Informational

Analytical

Specialists exploit all four in their chosen market. Generalists catch obvious patterns, usually late.

Ultimately, generalists provide liquidity for specialists.

Choose one market. Study it obsessively.

Let others chase shiny objects while you build genuine expertise.

Markets move because specific players have predictable constraints

Markets aren't abstract charts—they're arenas filled with identifiable players operating under clear rules and constraints.

Your job is to know them so well you predict their next move.

Meet the real market movers:

Commercial Hedgers: Southwest Airlines doesn't bet on crude direction. They lock in fuel costs, creating predictable, price-insensitive flows.

CTAs & Systematic Funds: Models without emotions. A 60-day high triggers delayed buying over multiple sessions—predictable and powerful.

Institutional Asset Managers: Pension and index funds rebalance like Swiss clocks at month-end and quarter-end—be positioned before they are.

High Frequency Market Makers: Provide liquidity in calm. Vanish when uncertainty strikes, signaling impending volatility.

These players aren't choosing—they're mandated. Forced action creates your predictable opportunities.

As I've discussed in "Why Most Traders Can't Scale Their Best Strategies—And How to Fix It", understanding these structural forces separates scalable traders from perpetual retail participants.

Every market breathes with its own rhythm, and trading against it is like swimming against a riptide

If you don't know your market's volume distribution by 30-minute increments, you're trading blind.

ES (S&P 500) Futures: The game is played from 9:30-10:00 AM ET. Overnight positions unwind, institutional orders flood in, volume spikes 3-10x the Globex average (depending on volatility). This is when our desk makes most of its money—has been true my entire career.

The dead zone starts around 11:45 AM and extends to about 1:15-1:30 PM ET. Spreads widen, volume craters, false signals multiply.

I've seen more accounts blown during lunch than any other time, traders forcing trades when the market offers nothing but noise.

The closing ramp begins around 3:35 PM ET as the NYSE MOC imbalance feed kicks in.

The real action accelerates after the 3:50 PM MOC freeze, creating another volatility spike into the 4:00 close.

Most successful day traders make their money from 9-11 AM and 3:35-4 PM. This pattern has held for decades.

Crude Oil (CL) Futures: Wednesday mornings at 10:30 AM ET—the EIA inventory report. More volume in 30 minutes than the previous 3 hours combined. Swings can be violent—moves of multiple dollars can happen in under a minute. (Note: This shifts to Thursday at 12:00 PM ET on holiday weeks.)

The settlement window is laser precise:

The formal VWAP calculation uses trades from 14:28:00-14:30:00 ET, but heavy TAS flow begins building around 2:20 PM. If you're not positioned before then, good luck.

Peaks are your opportunities; troughs mean step away.

Professional traders know daily ranges like their own phone number

Professionals understand risk concretely—in points and dollars.

As detailed in "Making Decisions Under Uncertainty", perfect edge identification means nothing without precise risk calibration. You'll still blow up if you can't size properly.

Mastering Volatility:

Track your market's 20-day Average True Range (ATR). This is your baseline "normal" range—know it as well as you know your phone number.

Recent ES volatility:

April 2025: ATR ~65-70 points ($3,250-$3,500 per contract)

May 2025: ATR rose to ~90-95 points ($4,500-$4,750 per contract)

June 2025: ATR currently ~106 points ($5,330 per contract)

These aren't just numbers—they're the market screaming that conditions have changed. Are you listening?

Define your regimes clearly:

Normal (≈ baseline): Standard position size

Elevated (>1.5x baseline): Reduce size 30–50%

Extreme (>2x baseline): Minimal or no positions

Position sizing formula:

Contracts = Account Risk $ ÷ (ATR × Point Value)

When volatility doubles, halve your size. Markets signal heightened risk explicitly—heed the warning.

Understanding Where Stops Live:

Professional traders know where amateur stops cluster like fish in a barrel:

Just beyond yesterday's high/low

At round numbers

Beyond obvious support/resistance

When price approaches these areas with momentum, watch for the acceleration.

Stops trigger in cascades, creating that distinctive "whoosh" as price spikes through—followed almost invariably by violent reversals once the stops are cleared.

This is liquidity being hunted, and if you understand the game, you can position yourself on the right side of it.

This is why I like to place my stops roughly half a day's average range from key levels to avoid stop runs.

Respecting Gap Risk:

Futures markets contain a unique monster that stocks don't: the limit move. This isn't some academic concept—it's an account-killer that strikes when you least expect it.

Scheduled Gaps are manageable because you see them coming:

FOMC announcements, NFP releases, crop reports

You know the date, the time, the potential impact

Size down or stand aside—there's no shame in avoiding a coinflip with asymmetric risk

Unscheduled Gaps are the true killers:

Geopolitical shocks, natural disasters, algorithmic meltdowns

No warning, no preparation, just pain

Remember lumber in 2021?

When it locked limit up for consecutive days, shorts weren't just losing money—they were trapped, watching helplessly as their accounts evaporated.

The market moved from $600 to $1,700 while they couldn't exit.

During February–April 2021, when the daily limit was $48/MBF, a 3 day lockout meant shorts were underwater by over $140/contract before they could even attempt to escape.

This is why position sizing matters even when markets seem calm.

Before holding any position overnight, ask yourself:

"If this market gaps 5% against me—or worse, locks limit—can I survive?"

If you hesitate for even a second, you're too big. Reduce size or get flat.

The order book speaks a language most traders never bother to learn

The DOM isn't just flickering numbers—it's a real-time map of supply, demand, and intention.

Price time priority: Your queue position determines whether you get filled or watch price reverse without you. When someone jumps ahead by one tick, they reset the entire queue.

Hidden liquidity: That refreshing 10 lot might actually be a 1,000-contract iceberg. Consistent absorption without price advance? You're watching hidden size at work.

News pivots: Major news events often create structural levels that persist for days or weeks. These become magnets for future price action—another subtlety only specialists recognize. That spike high from an FOMC announcement? It'll act as resistance for the following week.

Understanding order flow transforms the DOM from noise into actionable intelligence.

Every day, those who read it extract profits from those who can't.

The path to professional trading is paved with spreadsheets, not indicators

The real work isn't glamorous.

It involves building spreadsheets, charting volume profiles, documenting participant behaviors, and watching the same market until its patterns become second nature.

Most traders won't commit to this rigor.

That's precisely why your opportunity exists.

Your roadmap to building institutional-grade market knowledge

Weeks 1–2: Choose and Commit: Pick one market. 90-day minimum. No exceptions.

Weeks 3–4: Map the Participants: Log who trades when, track large orders, recognize footprints.

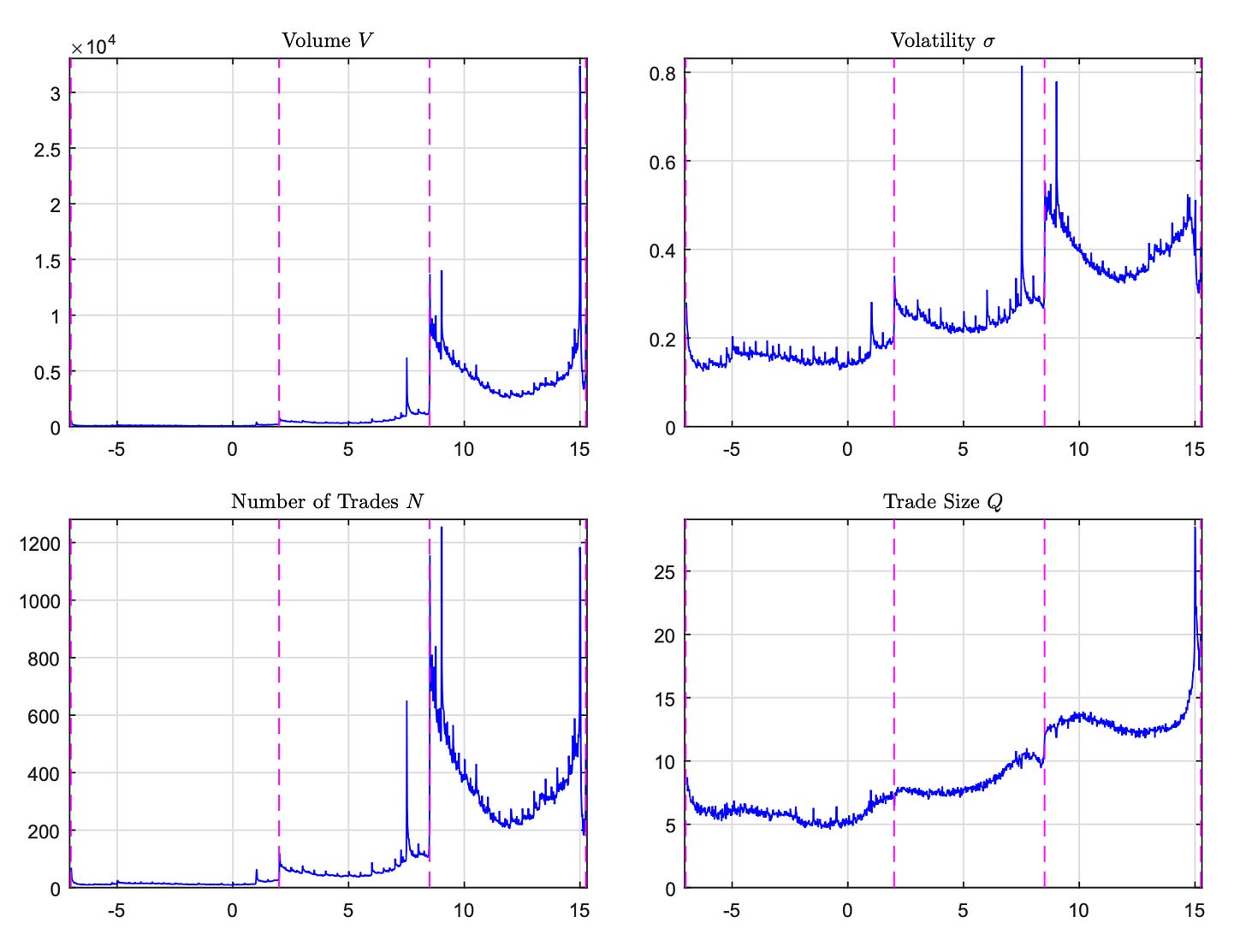

Weeks 5–8: Document the Rhythms: Chart volume and volatility in 30-minute intervals, building your market’s operating manual.

Weeks 9–12: Master the Nuances: Study order flow deeply, identify stop clusters, recognize hidden liquidity.

Ongoing: Track Evolution: Markets change constantly. Review quarterly. Adapt.

This approach ensures you're building genuine expertise, not just accumulating random patterns.

As I've outlined in "The 5 Essential Criteria Every Profitable Trading Strategy Must Pass", true edge must be durable, scalable, executable, measurable, and frequent—deep market knowledge delivers all five.

Your edge compounds with every observation you make

Markets consistently reward specialists who marry deep knowledge with systematic execution.

Every facet of microstructure compounds your edge:

Every participant behavior anticipated

Every rhythm mastered

Every risk understood

Every pattern recognized

The question isn't whether this matters—it unquestionably does. The real question is whether you'll commit to doing the work.

Most traders won't.

They'll jump between markets, chasing setups, wondering why their edge evaporates at scale.

That's precisely your opportunity.

Choose your market. Start observing. Build your framework.

The best time to develop microstructure mastery was five years ago.

The second best time is right now.

Because, ultimately, the uncomfortable reality is this:

Breadth creates activity, depth creates profits.

The work is hard. But the choice is simple.

Hi Ryan. Thank you for all of your valuable information.

I would assume that most traders at Raen are trading a single market with at least some trading multiple or many, is that correct? Is trading only one market a requirement, especially for new junior traders? Given so few markets seem to draw so much attention, is oversaturation or overexposure ever a concern? Do you perhaps find that you have a demand for traders of certain markets?

Thanks again!

Thank you sir. Absolutely loving these posts.

At the same time, I’ve seen some traders talk about going where the slot machine is broken/extreme inefficiencies—shifting focus based on where the best opportunities are, like chasing tickers based on news/catalysts, IPOs. I guess it comes down to personality, resources, and style. Both approaches seem valid depending on the trader's context and uniqueness. Thanks!