Why Edge Isn't Enough: What Professional Traders Know That You Don't

The missing pillar that explains why you can't scale your trading—despite having strategies that 'should' work.

Countless traders fail to make the transition to institutional capital, but not for the reasons most think.

The challenge rarely stems from a lack of edge—many demonstrate remarkable skill in reading markets and finding opportunities.

The missing piece is efficiency.

Ask most traders how they measure success, and they'll point straight to their PnL statement.

This narrow focus represents a dangerous blind spot.

Consistent, scalable profits demand both edge and efficiency.

This fundamental misunderstanding keeps most traders locked out of meaningful scale.

Edge Isn't Enough: The Missing Pillar Most Traders Ignore

Edge emerges from market experience, analytical insight, or quantitative research—whatever drives high probability favorable outcomes.

Some edges prove highly repeatable, while others target specific market dislocations for outsized returns.

Efficiency measures the economic cost of generating returns.

It encompasses exposure management, expected turnover, tail risk, and execution sensitivity.

This is where professionals truly differentiate themselves.

Edge only translates to institutional success when applied with precision, control, and scalability.

How Efficiency Separates Professionals

While many traders can spot profitable patterns, few can exploit them efficiently at scale.

This distinction becomes evident in return sustainability and capital deployment capacity.

In professional settings, efficiency shapes every aspect of strategy development.

Professional trading operations prioritize approaches that generate consistent returns while minimizing risk exposure, reducing profit volatility, and maintaining tight control over losses.

Traders who grasp this reality prove far better equipped to manage substantial capital allocations.

Identical Returns, Different Values: Why Path Matters More Than Profit

Consider two traders generating identical 100% annual returns.

The first achieves this through measured position-taking and precise execution, maintaining consistent risk exposure.

The second experiences dramatic equity swings, with deep drawdowns followed by aggressive recoveries.

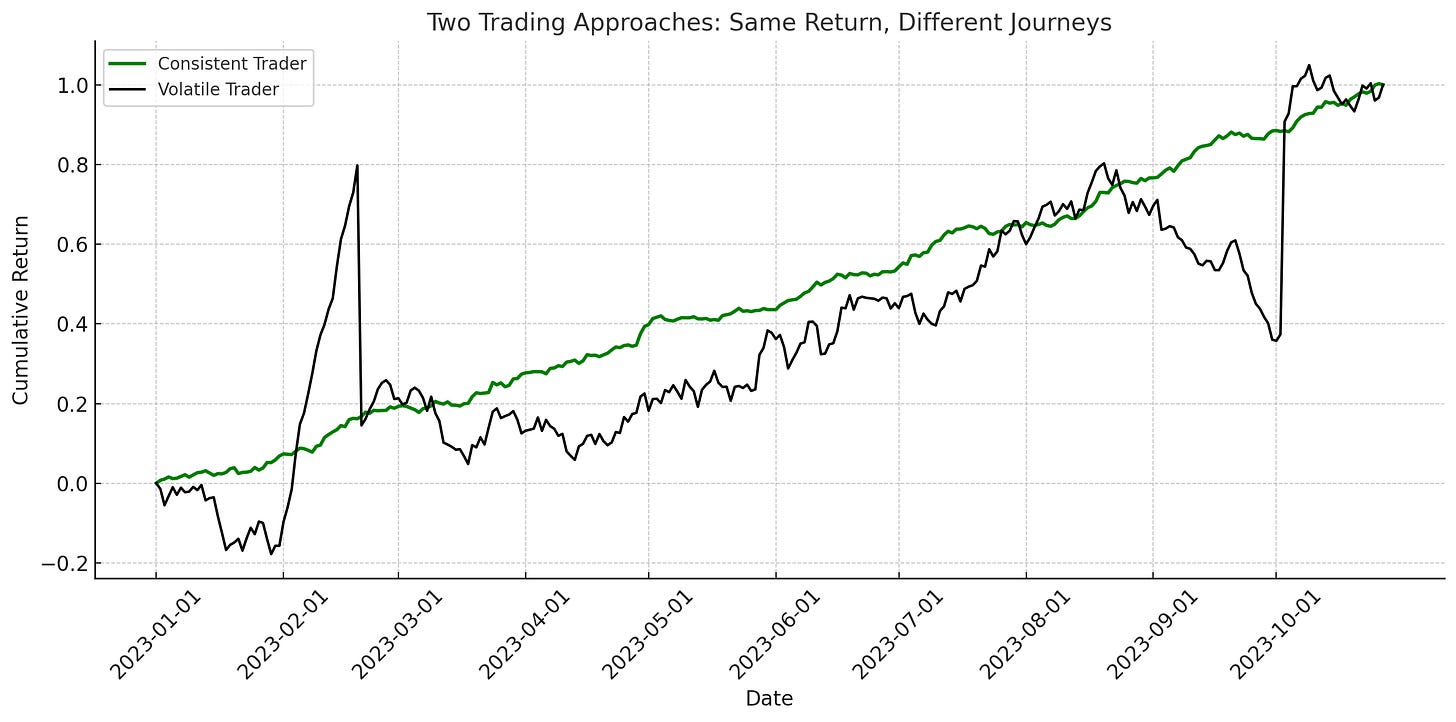

Figure 1: This visualization demonstrates our two-trader scenario. Both achieve nearly identical 100% returns over the same period, but through fundamentally different journeys. Notice how the volatile trader (black line) experiences severe drawdowns (-40%) and dramatic spikes (+80%), while the consistent trader (green line) follows a steadier path to the same destination.

While their PnL statements show the same bottom line, at institutional scale these traders operate in entirely different universes.

The second trader's volatility makes meaningful capital deployment nearly impossible, introducing three critical problems:

Psychological capital deterioration

Reduced strategy confidence

Elevated risk of forced liquidation during drawdowns

The stark contrast in equity paths shown in Figure 1 reveals what institutional allocators immediately recognize: the volatile trader's approach creates structural fragility.

During January-February 2023, this trader experienced a -20% drawdown before capturing an extraordinary move that briefly pushed returns to +80%. While retail traders might celebrate this recovery, risk managers would have likely terminated the allocation during the initial drawdown—eliminating any possibility of participating in the subsequent gains.

Later in September 2023, another dramatic drawdown occurs, creating precisely the kind of unpredictable equity fluctuations that institutional capital cannot tolerate at scale.

At size, these problems compound exponentially.

This explains why professional desks focus intensely on the path to profits, not just the end result.

This visual comparison illustrates why understanding efficiency isn't merely theoretical—it fundamentally determines capital capacity.

The consistent trader's equity curve creates the foundation for position scaling and institutional deployment, while the volatile trader, despite ending with similar returns, demonstrates precisely the characteristics that prevent meaningful scale.

The difference is not academic; it's existential to professional trading operations.

Beyond P&L: The Hidden Metrics Institutions Actually Value

Professional trading demands sophisticated performance evaluation beyond basic profit metrics.

Professional operations analyze order-level data to uncover efficiency indicators, including execution patterns, market timing effectiveness, and drawdown characteristics.

These metrics reveal how returns are generated—not just their magnitude.

Consider the equity curves shown in Figure 1. Professional trading operations would immediately dissect not just the end result, but the specific equity path characteristics.

They would examine volatility clustering, drawdown recovery patterns, and the relationship between market conditions and performance fluctuations.

The consistent trader demonstrates the hallmark of professional trading: repeatability within controlled parameters, while the volatile trader exhibits precisely the conditions that trigger institutional risk controls—often at the worst possible moments.

For example, a trader demonstrating consistent cross-asset returns with controlled drawdowns and efficient capital utilization offers a fundamentally different value proposition compared to one achieving similar results through concentrated directional exposure and volatile equity paths (like momentum traders in NQ futures).

Process Over Results: How Traders Access Institutional Capital

Traders who demonstrate superior efficiency naturally progress to managing larger capital allocations because their approach emphasizes repeatability over opportunism.

They consistently refine their processes, maintain disciplined execution, and scale position sizes effectively.

For discretionary traders especially, performance analysis extends deeper.

Trading journals reveal decision frameworks—how traders process information, manage risk, and navigate their own behavioral tendencies.

Loss resilience and strategy persistence determine long-term viability.

12 Metrics That Enable Scaling Beyond Retail

For traders looking to bridge the gap between retail and institutional approaches, certain metrics demand particular attention:

Quantifying Performance

Return Consistency: Profit distribution across market conditions and timeframes

Drawdown Management: Both interval-based and peak-to-trough metrics, with particular attention to drawdown frequency, depth, and recovery characteristics. As Figure 1 illustrates, even when returns are similar, drawdown patterns create fundamentally different risk profiles.

Risk-Adjusted Returns: Target institutional benchmarks like Calmar ratio > 2

Market Correlations: Understanding relationship with major risk factors

Process and Execution

Position Dynamics: Effectiveness in sizing and scaling positions

Market Timing: Quality of entry and exit execution

Risk Response: Systematic approach to market stress

Style Consistency: Maintaining edge across conditions

Trading Psychology

Decision Framework: Clear, repeatable trade evaluation process

Risk Management: Systematic position sizing and loss control

Behavioral Awareness: Understanding and managing cognitive biases

Loss Resilience: Maintaining discipline through drawdowns

Why Profitable Traders Rarely Become Professional Traders

The fixation on PnL metrics alone explains why so many talented traders plateau.

Finding profitable opportunities is necessary but insufficient.

The path from profitable trader to professional trader demands understanding that how you generate returns matters as much as the returns themselves.

When traders master both edge and efficiency, they see trading through an entirely different lens.

What initially appears as unnecessary complexity reveals itself as essential infrastructure for sustainable scale.

This transforms trading from a profitable activity into a professional operation.

The tragedy isn't that most traders never make this transition—it's that many don't even recognize it exists.

Great value, the 12 metrics clearly defines who’s worth sitting on a desk.